The Importance of Password Security

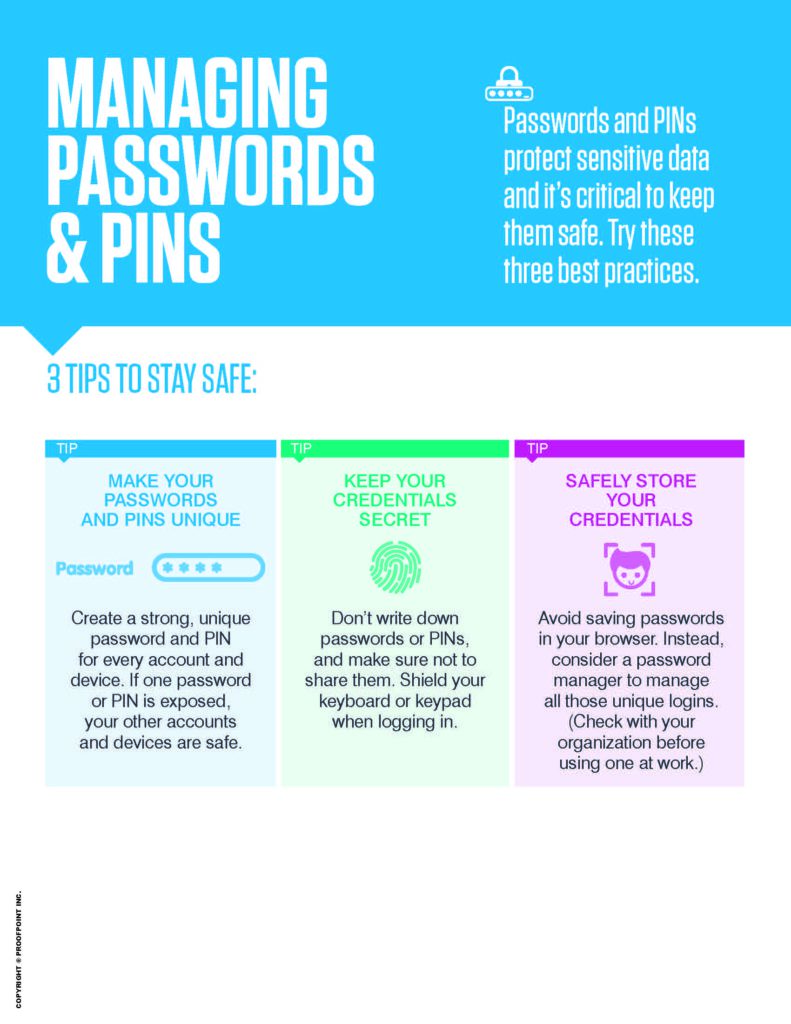

Weak passwords can compromise the best security tools and controls. With a never-ending list of applications and services that users and consumers access, people may have dozens of passwords to maintain at any given time. Often, the temptation to use familiar terms such as pet names, favorite teams or the names of children or friends […]

Be Aware of Tax-Related Scams

Protect yourself from these tax-related scams. Tax-related scams have become increasingly common, and they happen year-round. Fraudsters will contact you pretending to be from the Internal Revenue Service (IRS), a tax accounting service, or another tax-related agency. You could receive fake emails, phone calls, letters, or other communications. Be on high alert for phishing emails. […]

What is the SECURE Act?

The recently implemented SECURE Act can be confusing to understand. With my free eBook and customized advisory services, I can help you navigate how the SECURE Act may impact your financial strategy moving forward. Curious about what it means for you? Download the eBook for an overview of the SECURE Act. We’re here to help. […]

59½: Why is this age so important?

As you approach retirement it’s important to explore your options, health-care concerns, and get the best advice to successfully transition into those golden years. Learn how to prepare for retirement and navigate your Social Security benefits. We’re here to help. Download your free eBook to learn more

Estate Strategies: Critical Elements of an Estate Plan

With proper strategies, you may be able to maximize your opportunities and help manage stress and confusion for your loved ones. Learn the critical details to address when creating your own estate strategies. We’re here to help. Download your free ebook to learn more

Retirement Compatibility

Preparation for retirement is extremely important, and it extends well beyond finances. In addition to knowing how you’re going to fund it, you also need to know what your time will look like when you say you’re done with being a wage earner. With this new lifestyle, you not only need to determine how to […]

What Is A Fiduciary?

What is a fiduciary? When selecting a Financial Advisor, it’s important to know they will be looking out for you and the money you worked hard for all your life. Not all financial advisors are the same. When considering a financial advisor to partner with, it’s important to know if they are fiduciaries, meaning they […]

Year-End Financial Planning

Don’t get caught up in the here and now. Short-term moves and market timing are not sound financial strategies for your serious long-term plan of pursuing financial independence. Good planning does, however, require intermediary decision-making. A few things to consider before year-end: Charitable Giving – To receive 2020 tax benefits, donations must be made by […]

How Indecision Is Killing Your Pocketbook

Awareness is key to change, but you also need action. In fact, you need focused, decisive and immediate action to see change and to get yourself back on the road to financial independence. There are a lot of decisions to make when forging your way to financial independence, there are also countless paths to each […]

The Economy and the Election

Today, conversations, screens, and ads on how the upcoming election will affect our economy and the American way of life are unavoidable. Naturally, we start to ponder how the outcome might impact our own financial independence. Since market forecasters and economic commentators ever really get it right only part of the time, formulating investment […]