Useful Tips to Optimize Your Retirement Planning

Planning for retirement amid changing market dynamics can be stressful, especially as retirement age approaches. Fortunately, there are a myriad of ways to prepare for it, even if you plan to retire early. OPTIMIZE YOUR RETIREMENT INCOME One of our top tips is to optimize your retirement income by setting yourself up with a diversified […]

The Role of Insurance in Financial Planning

Financial planning involves thoughtfully outlining objectives and setting goals in your Life Plan. With anything, the possibility of running into obstacles, options, and challenges throughout your financial journey is unavoidable. That’s why it is important to implement some sort of checks and balances to mitigate these challenges. Insurance is one of the best ways to […]

Key Questions to Discuss with Your Estate Planner

Estate planning is an essential step to help protect the wealth that you’ve spent your life building. Meeting with an estate planner will help to create a comprehensive plan that will allow your assets to effectively pass to your assigned beneficiaries. Creating this initial plan can feel overwhelming, and we are here to help you […]

High Inflation…It’s a Good Thing

Ok now that you’ve recovered from falling off your chair after reading the tile of this blog, let me explain. Inflation is one of the biggest challenges in achieving, and maintaining, financial independence. The low inflation we have experienced for decades has made many of us lazy when it comes to spending. Now is the […]

Pullbacks, Corrections, and Bear Markets

When the market drops, some investors lose perspective that downtrends and uptrends are part of the investing cycle. When stock prices break lower, it’s a good time to review common terms that are used to describe the market’s downward momentum. Pullbacks A pullback represents the mildest form of a selloff in the markets. You might […]

Your Emergency Fund: How Much is Enough?

Have you ever had one of those months? The water heater stops heating, the dishwasher stops washing, and your family ends up on a first-name basis with the nurse at urgent care. Then, as you’re driving to work, you see smoke coming from under your hood. Bad things happen to the best of us, and […]

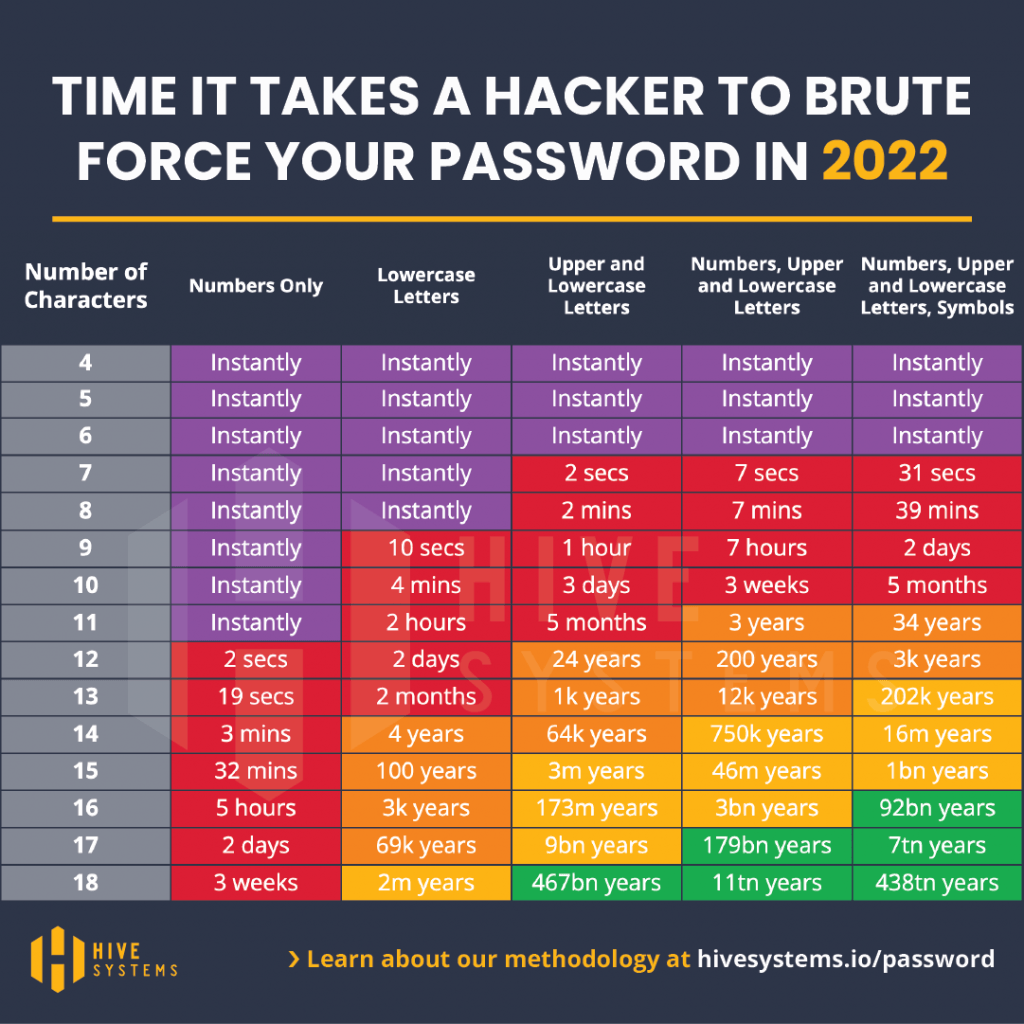

How Strong Are Your Passwords?

How long do you think it would take a hacker to crack your current passwords? On average, it takes a hacker about 2 seconds to crack an 11-character password that only uses numbers. See the attached chart that illustrates the time it takes for a hacker to brute force attack your password. A brute force […]

Financial Advisory and a Service-Centered Approach

Financial advisory firms have historically endured a bad reputation – either because they were too expensive, or they only helped people with lots of money to invest, or they were trying to sell clients a product or plan that didn’t align with the heart of their goals and situation. Too many Americans don’t think they […]

Is it time to Re-evaluate your Financial Plan?

Re-evaluating your plan and re-evaluating your opportunities is really important. According to Northwestern’s 2020 Planning and progress study, 71% of Americans feel their financial plan could use some improvement. So maybe you have a plan, but you’re saying, “Maybe I can use some improvement”. At Trilogy Financial we look at the work that’s been done […]

The Knowns & Unknowns

Here’s a tip: Review your spending habits. It’s really hard to mitigate or manage financial anxiety if you don’t have a clear sense of your spending. When talking with clients, questions that come up all the time are “Where’s my money going? I don’t know where all of our dollars go, we’re making a good […]