Have you ever envisioned a life of Financial Freedom and Leisure?

Have you ever envisioned a life where the chains of daily grind are broken well before the conventional retirement age, paving the way for a life of financial freedom and leisure? Embracing financial discipline and frugality can pave the way to a comfortable early retirement, answering the pressing question: Can meticulous financial planning and a frugal lifestyle significantly hasten your journey to early retirement?

What Makes Financial Planning Crucial?

Financial planning goes beyond merely saving a portion of your income; it's about understanding and rectifying financial bad habits that may impede your journey towards financial stability. Everyday financial misbehaviors such as impulsive spending, credit card debt, and the lack of a structured financial plan for emergencies often go unnoticed but have a long-term detrimental impact on financial health. Addressing these personal finance habits is the first step in financial planning.

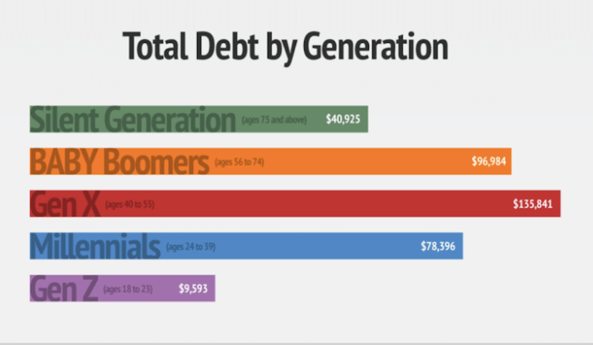

- Why is Debt Management Essential? A key aspect of financial planning involves managing or eliminating debt, which can otherwise consume a significant portion of your income in the form of interest payments.

- Did you know in the US for 50-59-year-olds the average debt is $23,719 1.

- How Can Budgeting Secure Your Financial Future? Being unsure of where your money is going is a red flag. Budgeting is crucial to track and control spending, ensuring your expenditures align with your values.

- Did you know the average individual aged between 65 to 74 spends about $55,000 on living expenses annually2.

- How do Savings and Investments Impact Your Retirement Goals? Setting aside money for an emergency fund and future investments is essential. Automating this process by having a portion of your income transferred to savings or investment accounts can help in cultivating this good financial habit.

What Does Adopting a Frugal Lifestyle Entail?

Frugality is about making informed and restrained financial decisions to save money. A frugal lifestyle encourages avoiding unnecessary expenses and finding value in what you spend.

- Examples of frugal practices include avoiding spending triggers like malls or online shopping platforms, utilizing cash over credit to prevent overspending, and finding cost-effective alternatives for everyday expenses.

Did you know 20% of Americans don’t save any amount of their yearly income, and 42% have less than $10,000 saved for retirement4.

What are the Key Components of Financial Planning for Early Retirement?

- Emergency Fund: Ensuring you have an emergency fund can help buffer against unforeseen circumstances like a job loss or medical crisis, which might otherwise derail your financial plans.

- Investment Strategy: Diversifying your investments and aligning them with your retirement goals is imperative for financial growth.

- 84% of Americans have a higher income than their parents did at the same age, indicating potential for savings and investment if managed wisely4.

- Tax Planning: Efficient tax planning can help in preserving your wealth and ensuring more of your money is working for you rather than going towards taxes.

- Healthcare Planning: As healthcare costs can be exorbitant, planning for these expenses is crucial to avoid financial strain in later years.

- Healthcare can be a significant part of living expenses, as seen in the $55,000 annual spending for individuals aged 65-745.

Which Tools and Resources Can Aid Your Financial Planning Journey?

There are myriad tools and resources available to aid in your financial planning journey. Budgeting apps, financial advisors, and online courses are excellent resources. Trilogy Financial, for instance, offers a Decision Coach program designed to provide additional accountability and coaching to individuals seeking financial guidance.

- 37% of workers aged 25 and older, and 19% of retirees, report not knowing where to go for financial or retirement planning advice5.

Easily Meet with a Certified Financial Planner.

How Have Others Achieved Financial Independence and Early Retirement?

The quest for early retirement often begins with a thorough re-evaluation of one's financial plan, identifying areas of improvement, and capitalizing on unforeseen savings opportunities. The year 2020 saw many Americans saving more, with an average of 10% more money saved compared to 2019, mainly due to lifestyle changes induced by the pandemic. Some redirected these savings towards home improvements, while others saw it as a stepping stone towards drafting a solid financial plan aimed at debt reduction, college planning, or accelerating the journey to financial independence.

Various individuals and communities dedicated to frugal living and meticulous financial planning have emerged over the years, showcasing diverse pathways to early retirement. Here are a few noteworthy examples:

- Juan's Early Retirement Ambition: Juan, an aspiring early retiree, aimed to bid farewell to his federal job by 2031 at the age of 43. His strategy revolved around living off savings, investments, and dividends post-retirement to enjoy more time with family and delve into philanthropic ventures. Though new to the Financial Independence, Retire Early (FIRE) movement, Juan's no debt and $85,000 asset accumulation puts him in a favorable position towards achieving his goal1.

- The FIRE Movement: The Financial Independence, Retire Early (FIRE) community exemplifies the synergy between frugal living and early retirement. Members of this movement, like Juan, embody a lifestyle of extreme savings and frugality, aiming to retire much earlier than the conventional age2.

- Young Adults Eyeing Early Retirement: The allure of early retirement isn't confined to older age groups. One in four individuals between 18 to 34 years old has set early retirement as their significant financial milestone, driven by the principles of frugal living and meticulous financial planning3.

- A 5-Year Transition Plan: A couple outlines their 5-year plan towards financial independence, with one partner continuing full-time work for an additional 3-4 years, demonstrating a balanced approach to achieving early retirement while maintaining a comfortable lifestyle4.

- Frugal Living as a Fast Track to Early Retirement: The narrative of saving 75% of income, a hallmark of frugal living, expedites the journey towards early retirement, allowing individuals to accumulate substantial savings, invest wisely, and achieve financial independence sooner5.

These cases highlight the transformative impact of frugal living and prudent financial planning to achieve early retirement dreams. They speak to the importance of continuous financial plan evaluation, adapting to changing circumstances, and leveraging savings opportunities to expedite the journey to financial independence and early retirement.

Conclusion:

The road to early retirement is laden with challenges, primarily stemming from our own financial bad habits. However, if we create a financial plan, adopt a frugal lifestyle, and leverage available resources, overcoming these challenges and retiring early is an achievable goal.